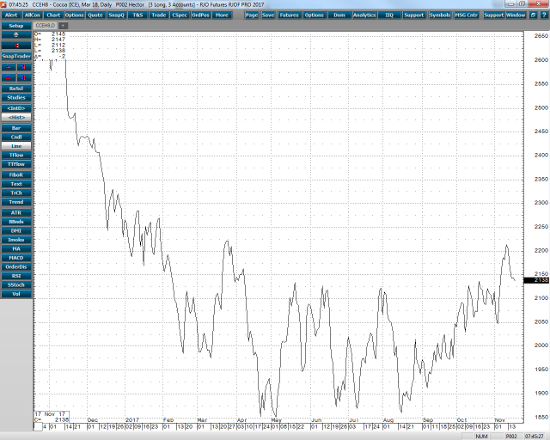

The cocoa market looks to be finishing up the week the same way it started on a weak note. Nonetheless, many are still very animated at the fact that we are still trading above 2100 even after a very volatile week in the currency and equity markets. It is these outside markets that play a large role in how one gauges the cocoa market when there is not a great deal of information out on the street. Therefore, I would argue that one should keep in mind that if we do see a large bearish move in equities that investors in long-term bullish cocoa positions may wish to find ways to cover their risk. Granted, the contract, basis March, still reflects a nice up trend that we could follow up another 100 ticks. This especially could be the case if we get any negative weather information in the next couple of weeks just prior to the Harmattan in West Africa. I have always found that in these situations very inexpensive put options going out no more than 30 days is a great way to cover risk. It will not cut much into ones profit moving forward, but will help make up some of the downside during the long waiting game. The range one may want to follow going into next week is 2160-2200 on the upside and 2110-2095 on the lower end.

Cocoa Mar ’18 Daily Chart