Anyone who has read the book, Reminiscences of Stock Operator, may recall reading that it is no longer pioneer work and therefore it is not pioneer’s pay. Perhaps the reverse is true for bitcoin. For many, this seems to be the attraction to the upcoming bitcoin futures offering anticipated for Q4 release by the Chicago Mercantile Exchange, as many see blockchain technology and cryptocurrencies as the disruptive future of exchange. For those who fear what they do not understand, the opportunity to short an exchange traded contract on a perceived bubble is equally attractive.

For the uninitiated in blockchain and cryptocurrency, the pros are peer to peer, decentralized, non-central bank exchange in an increasingly digital world. The cons (as perceived by some) are the disruptive qualities of the concept, its youth, lack of intrinsic value(akin to fiat money), and the realization that while unlikely and scarce, there are risks to blockchain networks and the internet as a whole.

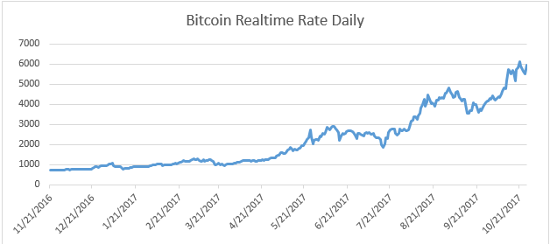

Regardless of which side you take in the bitcoin debate, perhaps the people behind the numbers are lying, but the market does not. The chart below is the past year of the Chicago Mercantile Exchange’s daily Bitcoin Reference Rate.

Even skeptics of bitcoin and blockchain are capable of noting the energy costs of mining such cryptocurrencies in terms of electricity and oil, etc.