The Members of the Organization of the Petroleum Exporting countries, and other key producers like Russia, are set to meet on November 30 to review the current production limits in hopes to increase the price of oil. In the previous meeting, they cut the production by 1.8 million barrels per day and agreed to keep their output down until March. This meeting should be no different as the members of OPEC are expected to keep the production prices lower.

Traders need to be prepared for selloffs after the report as the market doesn’t seem able to hold the prices up at the current price levels. There are a few dollars built in to the price going into the meeting that should come out after they release the results. What I find most interesting is the price differential between front month December WTI verse 2, 3, and 4 years out. For the first time in a dozen years the further out years are trading substantially less than the spot month. In some cases it is $3-$5 difference in prices. That shows the decrease in demand going into the future which is something oil traders should be watching close. Traders need to watch some developments going on around the world. It’s very interesting that Saudi Arabia is selling bonds on futures oil production. The Saudis are the best oil traders and selling their rights to the oil fields should make traders think twice about longer term growth.

Long term downside pressure will pick up in 2018 as the electric automobile industry expands by offering cars at more affordable prices. China just announced they are going to ban combustion engines not too far in the future as they push for electric vehicles. California is also looking at similar laws.

It’s going to be interesting watching oil over the next few years. Traders need to think long term strategy to rebalance exposure to the upside in oil.

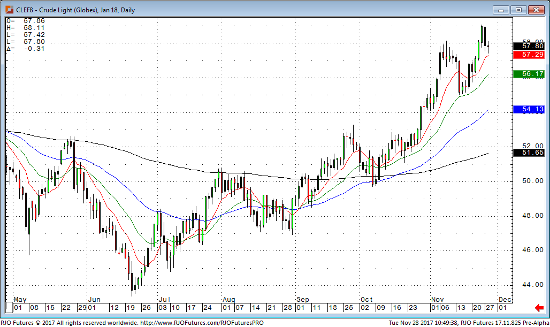

Jan ’17 Crude Light Daily Chart