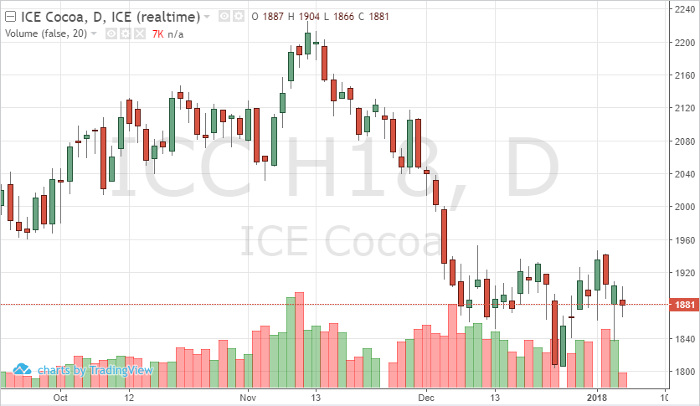

So far we have seen some volatile trading in cocoa. We saw a slight move higher than a sell-off earlier this week – now some consolidation should be seen in the March contract next week. Global demand is strengthening, providing support for the further out contracts. With the help of Asia, it is projected that the global supply and demand should be closer in balance this calendar year. The market hasn’t taken off yet due to the news that exports out of Ivory Coast are ahead of last year’s pace – although some analysts don’t believe this is an accurate reading. Ivory coast saw late arrivals last year that affected the export data which skews the information. ICE reported cocoa stocks dropped for the seventh month. A drop in stocks like this, about 40% since May, could be bullish and help the North American demand outlook. The currencies have provided support to cocoa futures – euro and the pound specifically. A technical move higher, above 1960 is needed to reaffirm the news we are given for the anticipated outlook in 2018.

Cocoa Mar ’18 Daily Chart