Asian shares were weaker, and were led by losses in the Nikkei due to the recent strength of the yen. The GfK survey on German consumer confidence and the IFO survey on German business climate both came in better than forecasted. European shares are having mixed results early with the German DAX under mild pressure, while the Italian MIB and Spanish IBEX 35 are posting moderate gains. A highlight for global markets will come with the results of the European Central Bank’s latest monetary policy meeting which is forecast to have no change to either rates or policy. The U.S. session will start out with a weekly reading on initial jobless claims that is expected to have moderate increase from previous 220,000 reading.

With a wide range outside day Wednesday, the market feels a bit top heavy and extremely overbought. In fact, March E-mini S&P has closed higher in 14 of last 16 sessions. Strong global growth prospects and strength in emerging markets are factors which helped support. Traders seem to be growing more concerned with protectionist US policy could be a factor to spark a correction. The trend remains up and bull camp has not been easily discouraged by trade war concerns, North Korea issues or even political wrangling in the US. Support comes in at 2830 with resistance at 2876.

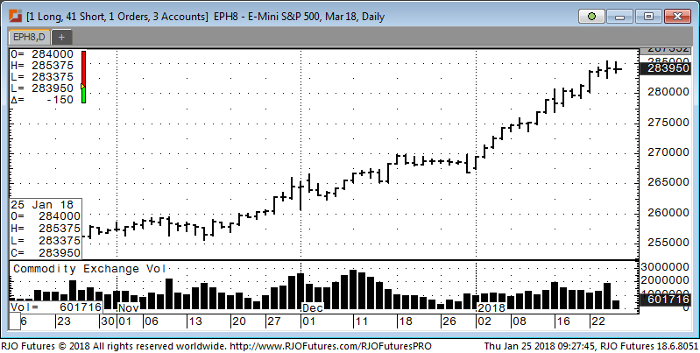

E-mini S&P 500 Index Daily Chart