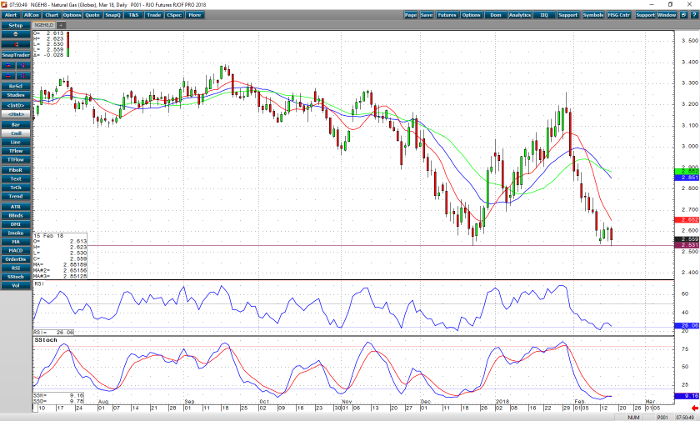

The trend in March natural gas is clearly down. However, it seems that we have a temporary low with a double bottom around 2.532. This may be used as a number to base further bearish decisions upon. A close beneath this low may signal further selloffs to new contract lows. If this support number holds, and the market bounces off and rejects further lows we may see a correction of the current trend. A close above 2.700 may be necessary for the bulls to regain control. Momentum studies are at oversold levels and starting to show signs of turning. Moving averages are all trending lower and caution should be used when initiating new bullish positions.

Weather is forecast to be warmer in the near term with temperatures expected to be seasonal to above average until the end of February. Today’s storage number is expected at -193 bcf. Average draws for the past 5 years run around -150 bcf. Even with the larger draw the bears seem fully in control. To see a return to higher prices we would need an extreme number on the draw, or a big surprise in the weather forecast to colder weather. I’m cautiously bearish, keeping an eye on prices near the bottom of the range.

Natural Gas Mar ’18 Daily Chart