China is hopeful that the increased selling of corn from state reserves will curb the rise in corn values. The USDA report is expected to show US corn ending stocks at 2.197 billion bushels compared to 2.127 billion bushels last month. Argentine production is estimated at 33.3 million tonnes vs. 36 million in March. Support yesterday emerged from the cold and wet forecasts through April 22 which will keep planting progress moving very slow. Many farmers will be delayed by as much as three weeks or longer from “normal” planting dates. This may push pollination dates into late July or possibly later depending on weather moving forward.

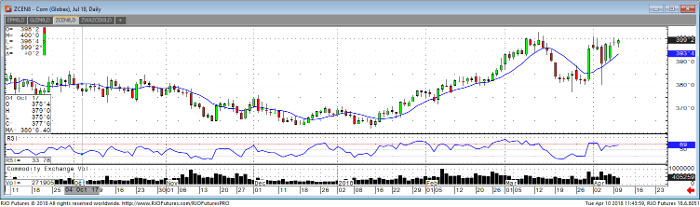

December corn traded up to a new high for the move yesterday. The trade is fully aware the ending stocks number today should be 50-100 million bushels above last month due to the data in the march stocks report. Any pullbacks should be well supported by weather. Resistance is at 392 and 395 with support coming in at 389 and then 386.

Corn Jul ’18 Daily Chart