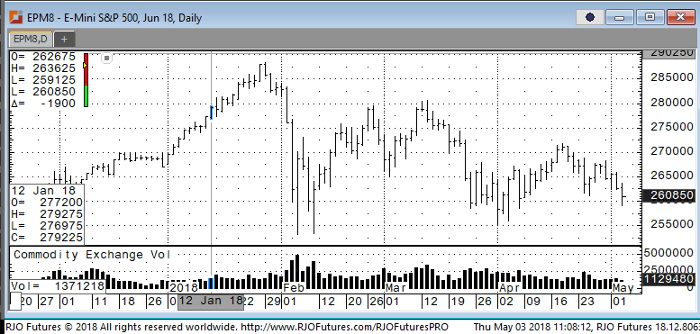

The overnight global markets were mixed with Pacific Rim markets higher and the rest of the world generally weaker. The performance in the equity markets after the mostly “dovish” FOMC result yesterday is suggestive of a market leaning bearish. As indicated already, the E-mini S&P has been presented with a series of potentially major bullish headlines and yet prices have remained within striking distance of this week’s lows and well below the last month’s highs. The larger picture shows that the E-mini S&P clearly remains within a three-month old downtrend pattern that doesn’t appear to have strong value until 2600. Even though the Fed is off the back of the market for now, there is hope for an improvement in US/Chinese trade relations but a decline below this week’s low of 2625 and disappointing data can push the market lower.

E-mini S&P 500 Jun ’18 Daily Chart