We witnessed history last night as POTUS met with president of North Korea in Singapore and apparently Kim has agreed to dismantle his nuclear arsenal. Now before everyone gets their hopes up that we are going to see a nuclear free Korea, everyone should remember the long history of this brutal regime. But, I believe it’s a step in the right direction that talks have been established and maybe just maybe we can all live without the constant worry that Kim could send warheads that aim towards the US. Markets last night were anxious watching for any negative verbiage coming out of the meetings but were disappointed. Markets were quiet and are continuing their lackluster movements this morning.

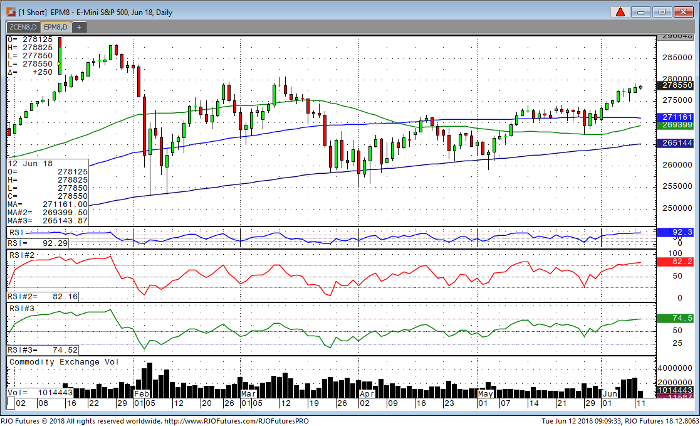

Today starts the two-day Fed meeting with an announcement coming tomorrow on rates. Consensus is that the Fed will hike rates a ¼ point but that is already priced into the market. More importantly, traders are waiting for the statement that will be released 30 minutes after the announcement. So, I would expect a slow day with a somewhat narrow range barring any news coming out of Washington. Technically, the S&P market looks great with the market making higher lows for seven consecutive days. I see resistance near 2807.25 which was the high back on March 13 and some support near 2748-50. I don’t see any good trades especially at these levels. To me, the risk reward jumping into the market at these levels just isn’t there. Be patient and look for explosive volatility tomorrow afternoon after the Fed and hopefully we will see some good trade set ups. If you would like to talk about the markets and pick my brain on where some opportunities lie, please contact me.

E-mini S&P 500 Jun ’18 Daily Chart