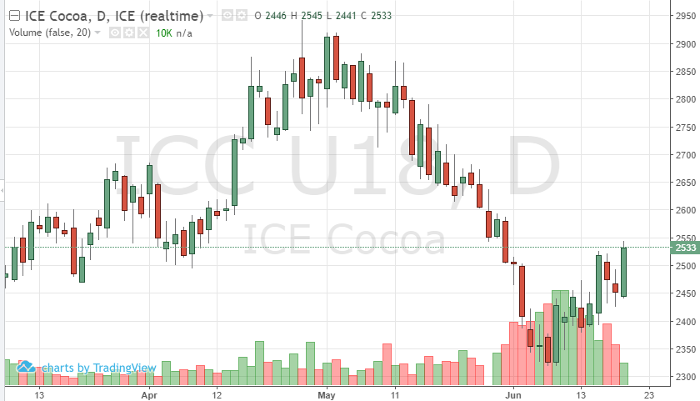

Supply concerns have taken over the cocoa trade again. September futures are trying to stay above 2500. A few weeks back there were concerns of prices moving lower due to weaker currency prices and no “new” news on the supply/demand side of the equation. Of late, new supply concerns have surfaced in key growing regions. The possibility of El Nino affecting crops later in 2018, early 2019 are also helping prices rally. There still isn’t the demand needed in Europe and N. America to really push prices back to levels we traded earlier this year. Prices in the euro futures – which recently hit an 11-month low and pound, hitting a 7-month low are hurting demand in cocoa as well.

For now, monitor potential weather premium that could take place. Look for any fresh supply news to provide support in prices. Cautious bullish traders can look for entry in the market by buying longer-term calls until we see more solid fundamentals for guidance.

Cocoa Sep ’18 Daily Chart