Treasuries have been on strong footing since mid-May as trade war talk has added uncertainty to the markets, and the ability of the Fed to raise rates aggressively in such an environment is being questioned. The yield on the 10yr note has spiked from a peak of 3.11 percent in mid-May to 2.86 percent this week.

According to the CME group the scale has tipped in the options market decidedly to the bullish side. The CME data shows that the purchase of calls has outweighed put buying by 2.4 million contracts. Additionally, the CFTC has recorded asset managers increasing bullish bets on Treasury futures by 103,000 contracts to 926,000 for the week ending July 3. The conclusion to be drawn here is the smart money is either buying insurance in anticipation of a stock market rout, or they believe growth and inflation will be more tepid than expected. Either way, they aren’t necessarily concerned with what the Fed is up to, as rate hikes primarily affect the short end of the curve.

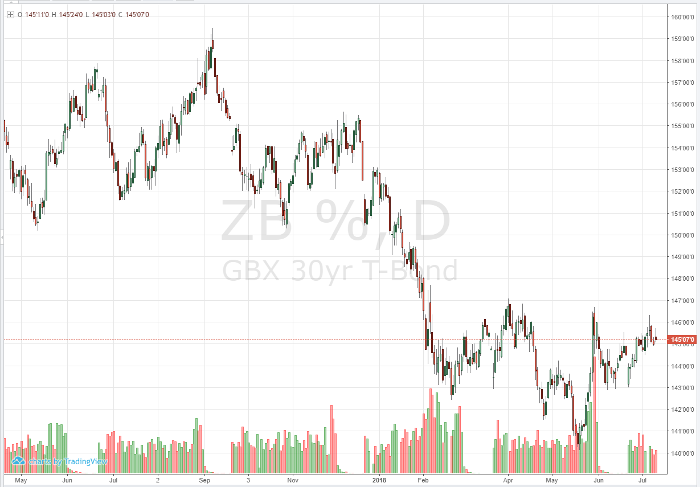

Technically, 30yr bonds are still hemmed within a range since Feb, between the 140 handle and the 146 level. Currently the Sep 30yr is trading 145’10, with a recent high of 146’11 on July 6. I think it makes sense to continue trading the range until it is broken. 30yrs are near the high of the range. With CPI coming out tomorrow it makes sense to get short exposure on a spike above 146. Expectations are for a rise of .2 aggregate, with the core CPI at 2.3 per cent. Of course, inflation will have to be lower than expected to get up there. Keep in mind this would be counter to the smart money, as noted above, but it makes sense in terms of price action.

30-Year T-Bond Daily Chart