Coffee fundamentals are the major driver to this incredibly bearish situation. Say what you will about September coffee being oversold, but you cannot ignore the fact that the supply/demand situation continues to suffocate coffee prices. The Hightower Group has reported “record high production from Brazil and a likely record high crop from Vietnam”. In addition, we’re seeing some added pressure on the Brazilian currency while the US dollar continues to show signs of strength.

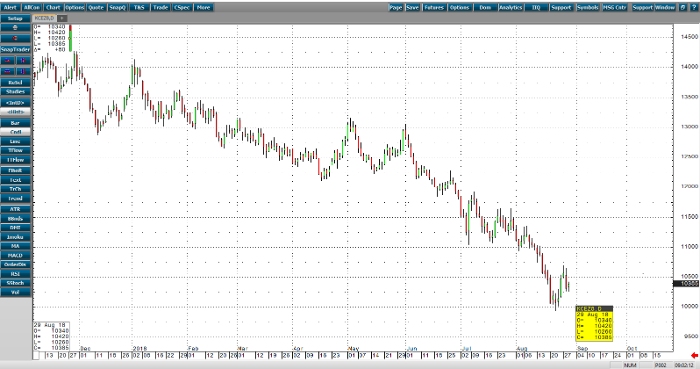

On the technical side, coffee struggles to hold support at 105, and reached sub 100 levels this past week. We’re now seeing a short-covering rally, but expect some solid resistance at the 105 area now. For now, we’ll continue to hold a bearish outlook but hold off on new positions until we see a rally back to approximately 10550. Consider using put options to manage risk effectively.

Coffee Sep ’18 Daily Chart