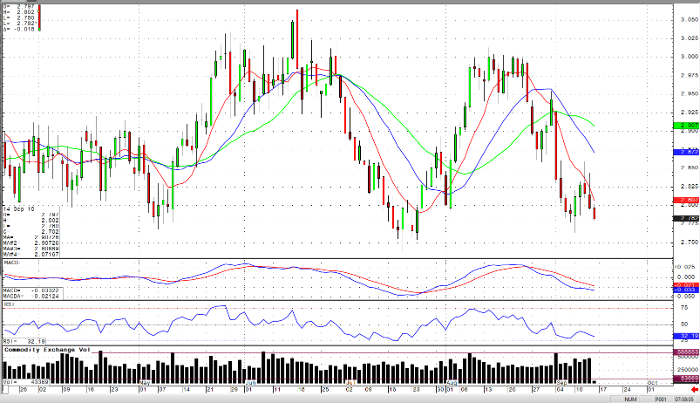

The general trend today, is down. Three days of lower high’s and lower low’s put the ball firmly in the bear camp’s court. Trade has been range bound between $2.760 and $2.900 this week. Short term moving averages are headed south along with momentum indicators signaling a move lower, or to lower trading range. There isn’t any divergence between momentum and prices, so a move in the same direction is in the cards. Support comes in around $2.760 ad close below that level can signal a move lower. Closing above $2.873 will be needed to change the trend to neutral to up.

Storage numbers came in a little higher than called for at 69 bcf compered to estimates of a 65 bcf injection. Hurricane Florence coming ashore may increase the need for power but not yet. We’ll just have to sit and wait it out. The storm has been down graded to a category 1 as it hits land but, major damage has been reported. Up to 400k people have been reported without power. The storm’s track will take it thru many states and possibly back to the ocean where it will gain more force. Trade to the down side should continue and I’m looking for prices to slow down near support. By then we’ll have a better handle on the cost of energy caused by Florence.

Natural Gas Nov ’18 Daily Chart