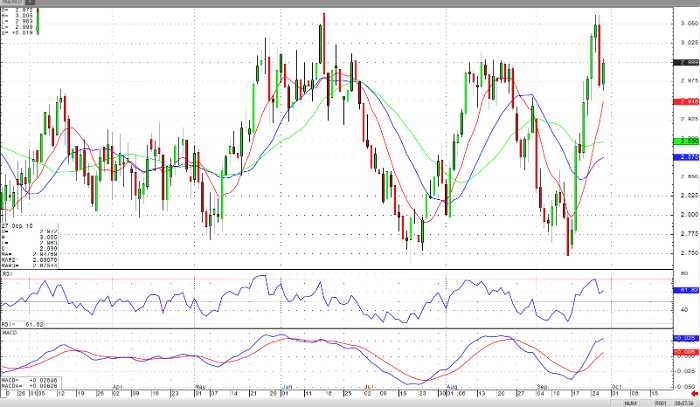

Natural gas storage saw another build in the EIA report with an injection of 46 bcf for the week ending September 21. Gas stocks still remain lower than a year ago, off 20%. Even with the drop in price, the general trend is still up. The prices are creeping toward the consolidation of nearly a month ago, and a close above $3.050 would be needed to take prices to the next range. Until we see that, prices should languish between $2.925 and $3.000. A close below $2.900 may shift the momentum back to a range from $2.900 to 2.800. Momentum studies are hard to read because of acceleration in price due to the aftermath of Hurricane Florence in south-eastern portion of the country. Over 800,000 were without power at the storm’s peak, we’ll have to sit it out and wait as much of the region comes back online. The start of the heating season is right around the corner but not affecting price yet. Shorter term MA’s are trending upward while mid-term, and longer-term averages are moving sideways. Resistance is at $3.000, and far out support comes in around $2.775-2.750, but I don’t think it will go there.

Natural Gas Nov ’18 Daily Chart