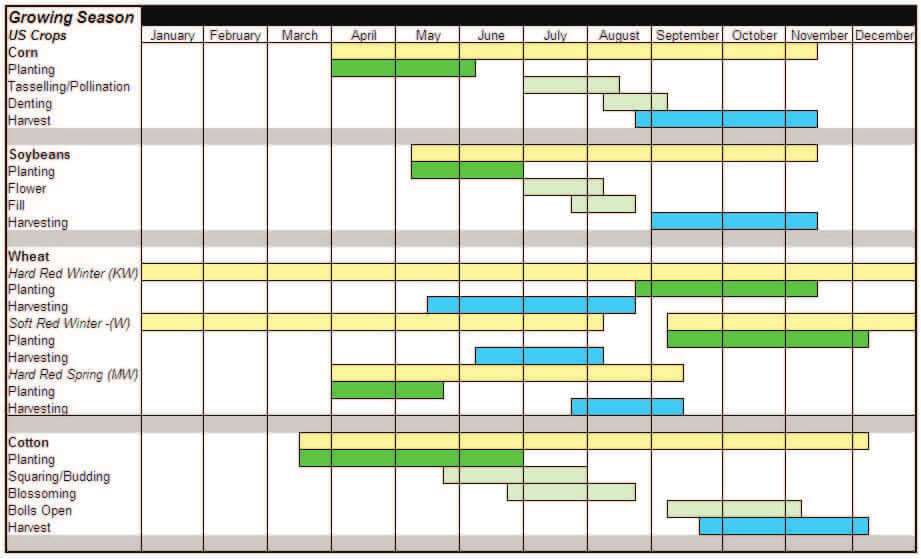

Late winter can be the time of year we normally see old crop versus new crop trades in many of the grain futures markets. New traders are often confused because market prices may be different for old and new crop. New crop refers to a crop that is to be planted in the future or is currently growing and has yet to be harvested. If you are buying crop that has already been harvested, you are buying old crop. Let’s use corn as an example. In January/February traders like to trade the spread of the upcoming December corn futures, which is typically lower than the upcoming May corn futures, because May corn is old crop and has already been harvested, therefore we have the actual harvest numbers. December corn is considered “new crop” and will not be harvested until October, so we don’t have concrete harvest numbers. Each grain market has its own new crop month, December for corn futures, July for wheat futures, and November for soybean futures.

Old crop prices tend to remain strong until prospects for the new crop are better known. Therefore, prices go up as supplies approach their tightest levels of the year. Prices are likely to remain strong until the crops get through critical planting stages and the risks of summer heat and drought. Grain markets all follow a regular cycle of planting and harvesting, regardless of weather conditions.

March and April are the planting months, whereas late September through early November are the harvesting months. So, March, May, July, August and early September are considered OLD CROP. November, December and January represent NEW CROP.

The Seasonality of Commodities

Seasonal tendencies are a composite of some of the most consistent commodity futures seasonal that have occurred in the past several years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year even if a seasonal tendency occurs in the futures, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the futures, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future. Past performance is not indicative of future result