June index futures are mixed as traders measure the longer-term pulse of the Trump rally. The administration suffered a major strategic defeat recently when the proposed ACA revisions were shelved in the face of a looming House defeat. Republicans will need to mend their egos and coalitions ahead of future policy debates, especially on tax reform.

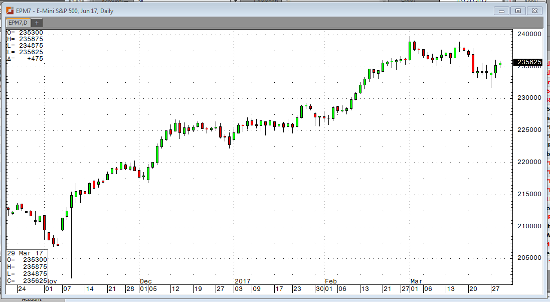

June gold futures are lower, trading near $1,255 (-3.5), with silver down at $18.33 per ounce. Precious metals have traded strongly during the last two weeks of March as the post-election rally has begun to falter. The June S&P contract is up near 2354 (+2.25 pts.) and the Dow is in the red by 46 points at 20,579. June bond futures are up, at 12419 (+8.0) and 15109 (+15.0) for Notes/Bonds respectively.

Crude oil is higher again near $49.30 (+$0.94), as the market weighs a rumored extension of OPEC output cuts. Following a strong sell-off towards the $47 per barrel level, futures have stabilized and bounced as to be expected. Supplies world-wide remain at significant levels and US production continues to expand.

On Friday at 11 am CST, the USDA will release the all-important quarterly Grain Stocks and Prospective Plantings report.