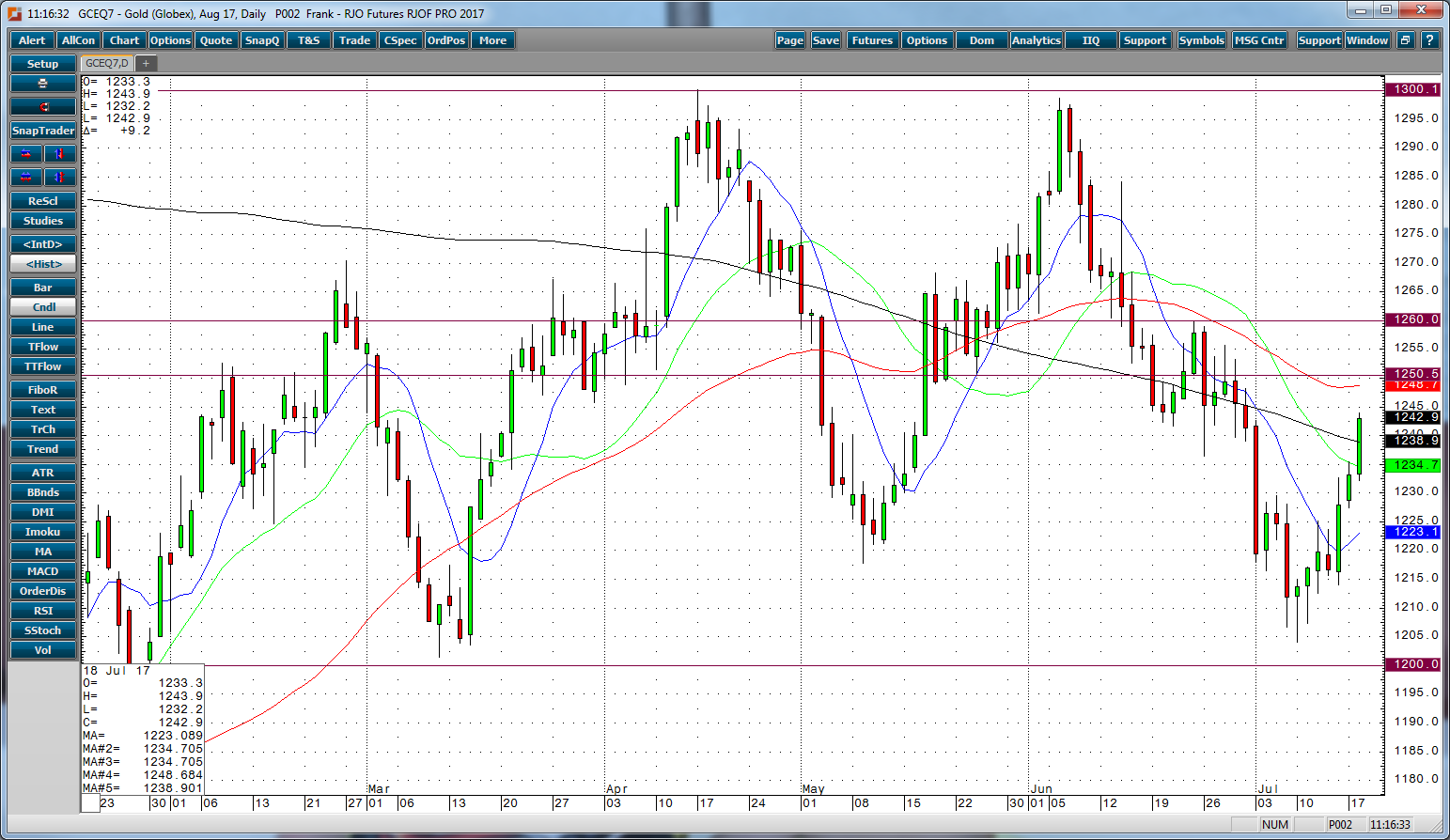

The May-June rally in gold that took the market from a low of $1,217.8 to a swing high of $1,298.8 was driven mainly by fear and uncertainty. It was the “safe haven” trade. A rally of $81.00 and another failed attempt by the market to take out good resistance at $1,300 proved to be enough to reverse the short term trend and leave a “double top” on the daily chart. The gold market was due for a correction and one would’ve thought that support around $1,265 would hold. However on June 14 the Fed, in their infinite wisdom, hiked rates in the absence of inflation and therefore accelerated the gold futures sell off. As I have been known to say in the past still holds true today, “it’s usually just a level on the chart that stops and turns a market around.” That level where the market found support was $1,200 and for the past seven trading sessions the gold futures have been trending higher. The next test for this bounce in the metal will be $1,250 to $1,260. A close above $1,250 would be considered friendly to the bulls in the market. Thus far, the rally in gold has been driven mainly by weakness in the dollar. The Fed Chairwoman, Janet Yellen, has made it clear that while the Fed will reduce its balance sheet it may not be necessary to raise rates much more as they see inflation below their 2% target. They cannot justify further rate hikes without inflation. The USD continues to move lower and therefore I expect that gold futures will continue to move higher for now.

Aug ’17 Gold Daily Chart