Price action in the September coffee futures continue to look very impressive as we near resistance levels not seen since May. Will we be able to break above the 140 level? If so, a break above this critical resistance area could prompt a continued bullish push to the 150 level rather quickly. Bullish near-term supply issues seem to be supporting September coffee prices quite well. While the US Dollar has garnered some strength as of late, so has the Brazilian Real, which has pretty much offset currency pressure on either side. The Brazilian harvest appears to be projecting a slight decline, which should also help support coffee prices.

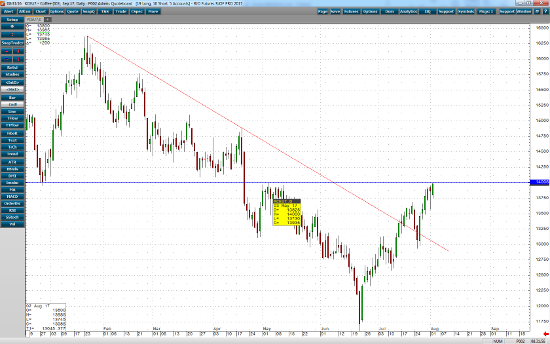

On the daily chart of September coffee below, we can see prices are aggressively testing the 140 high from May 3. At this level, we can see that prices have also aggressively violated a downtrend that’s been in place since January of this year. From a risk-reward perspective, a short position would be advised, risking slightly above the aforementioned resistance area.

Sep ’17 Coffee Daily Chart