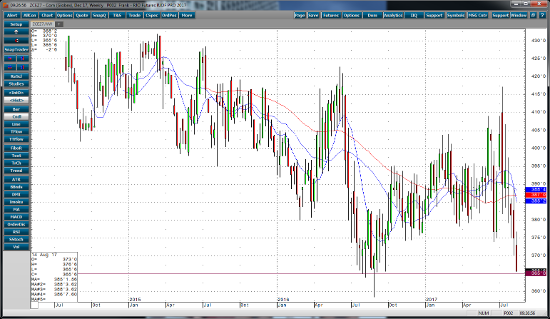

In my experience, when traders or market commentators start talking about no sign of a low…well then we’re getting very close to the bottom! When was the last time that everyone was right the market? Corn, beans, and wheat have all very quickly gone from over-bought conditions to over-sold conditions. How are we supposed to believe that four weeks ago that corn belonged at $4.17 or beans belonged at $10.47? How are we supposed to believe that there’s no bottom now? Of course there’s a bottom! It will be a level on the chart that stops the bleeding and then it will be the USDA lowering their yield projections which are currently grossly over stated. Markets always over reach on the way down because everybody is running for the exit. Grain prices will likely gravitate back to levels somewhere between the recent highs and lows.

I would be very surprised if corn can’t hold $3.65, maybe $3.60 support levels. Corn has gotten cheap now. Soybeans may need to test levels closer to $9.10, maybe $9.00 before recovering.

Bottom line is that there is just too much bearish sentiment in the grain markets and that in itself becomes bullish for the markets. Also, I just don’t believe that the USDA projections are right on yields. However, whether I believe it or not, the grains markets are currently under pressure from improved weather conditions and technical selling.

Corn Weekly Chart