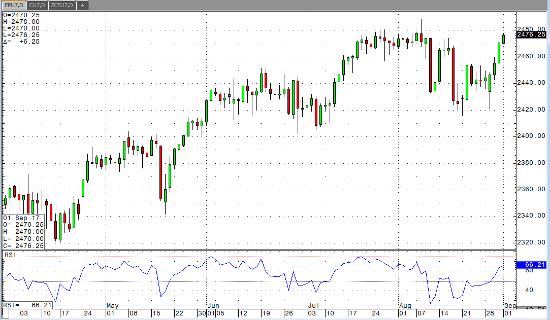

Earlier this morning, Nonfarm Payrolls came out showing an increase of only 156,000 jobs. We were expecting to see a number closer to 180,000. In addition to the weaker than expected number, we saw the July number revised lower by 20,000 and the unemployment rate tick up from 4.3% to 4.4%. While that isn’t great by any means, there was a bit of a surprise in the uptick in manufacturing jobs. We saw a gain of 36,000 manufacturing jobs and also so upward revisions for June and July. Reactions to the number have been pretty quiet, but the three major indices are all a bit higher at the time of this report. Heading into the holiday weekend, this upward action has to be encouraging. The Nasdaq printed a new high before backing off, and the S&P and Dow appear poised to make a run at their highs made on August 8. Labor Day is Monday and markets will be closed, or have abbreviated trading hours. Next week will be light on news, so traders will be monitoring the current geopolitical risks as well as any progress towards tax reform out of Washington D.C.

Sep ’17 Emini S&P Daily Chart