Stock indices appear poised to open at or near unchanged this morning. Considering the overnight turmoil we saw in London and North Korea and the miss on the retail sales number, this is actually somewhat encouraging for the bulls. While one could make the case that Hurricane Harvey was probably at least in part responsible for the weak number, this data reflects only the very beginning of the Hurricane. That said, it is pretty safe to say it will factor more heavily into the data moving forward.

The Dow, S&P, and Nasdaq head into next week’s FOMC meeting near all-time highs. Not many believe we’ll see any meaningful changes, but we’ll have to pay close attention to the dialogue for clues as to future rate hike decisions. After last week’s debt ceiling agreement, tax reform seems to have moved a bit closer to the forefront in Washington. Perhaps the recent agreement will prove to be a path towards a bit more progress there, but I’m not going to get too optimistic just yet. The two sides seem to be pretty far apart on this issue, but we’ll see if some kind of compromise can be agreed upon.

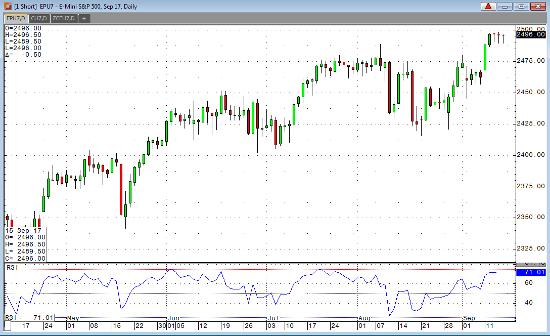

Sep ’17 Emini S&P Daily Chart