At what point does it make sense to use the futures markets to protect your stock portfolio against a downturn in the market? You have to have some protection against a market correction that is long overdue and will likely be sharp and swift when it finally does happen. Look at a futures account as an “insurance policy”. You hope that you won’t need it, but you’ll be glad you have it when the time comes to use it.

It’s extremely difficult, psychologically, to short a market that doesn’t seem to have a top. How many times have you heard recently that the Dow Jones has reached a new all-time high? It’s like a broken record. It defies logic, yet, the market keeps moving higher. We still have historically low interest rates. It looks like Washington might be able to get something done with tax reform, and whether they do or not, it’s still going to be a sell opportunity in my opinion. Geo-politics are always going to be a wild card and we have a president that can be unpredictable. We don’t know what the catalyst will be, but there will be an excuse to sell stocks at record levels.

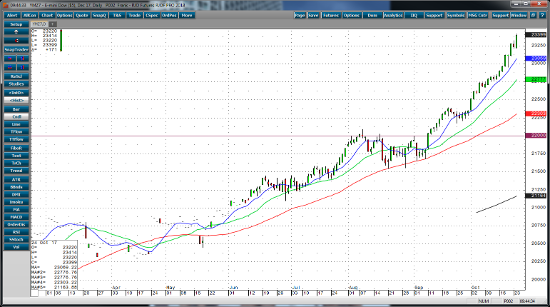

The Dow Futures, as of now, have rallied an additional 1,400 points just since September 12 when it finally broke out above 22,000. Today, it is trading at 23,400. That is a 6% increase in just six weeks! That’s 6% of 22,000! Is that really justifiable? It makes sense to use the futures markets to protect your portfolio against a downturn in the equity markets.

Dec ’17 Emini Dow Daily Chart