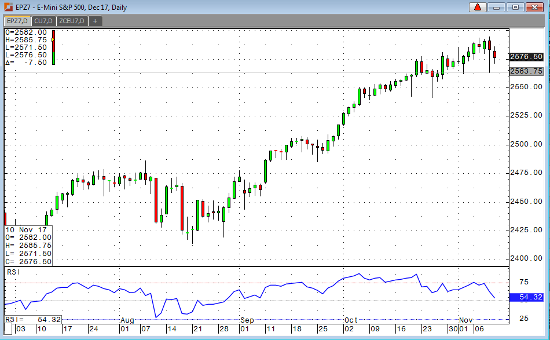

Stocks experienced heavy selling on decent volume during Thursday’s session, and it is spilling over into today. After seeing the biggest broad-based selloffs we’ve seen in weeks, the markets did manage to mount a decent recovery heading into the close. However, we’ve been unable to build on the recovery rally during the evening session. The biggest factor in yesterday’s selloff was the inaction in Washington. Markets have been rallying lately on strong earnings and the prospect of actual progress on tax reform. We’re coming to find out that betting on anything actually happening in Washington is a sucker’s bet, and it appears that we’ll have to wait on anything meaningful yet again. Today’s news slate is very light with a small number of earnings reports and Consumer Sentiment being the only data release. The slate picks up next week though with CPI, PPI, and Retail Sales being some of the highlights.

Dec ’17 Emini S&P Daily Chart