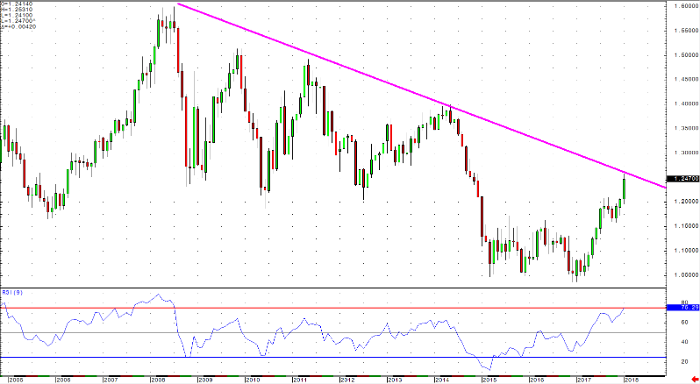

The US dollar is giving us an “exhaustion” signal on the downside, but certainly not a reversal of the down trend. If you measure and map the trade since Trump’s inauguration and “weak” dollar comments being good for global trade and business last January, we’ve been in a steady downtrend on the charts. Conversely, the Euro has been in a solid uptrend since the beginning of 2017. The European economy specifically the Northern states, have shown steady improvement and growth. However, the boogieman of the Euro Zone is the low levels of inflation and the Southern states that rely on “weak” Euro policy as a subsidy. The ECB has been tapering its QE bond purchases and strengthening is forward guidance on growth, and although we’ve seen an uptick in European bond yields, we’re suspicious as to how much further interest rates and subsequently the Euro currency can run. Back to the USD; US Growth and Inflation have accelerated all of 2017, pushing bond yields higher, however the dollar has failed to move in step with rates. With that said, we’re looking for consolidation in the USD in the near-term (we’re hesitant to call a bottom to this 1yr downtrend). Within this potential USD/EUR consolidation we’re going to be looking at buying opportunities in the USD (so long as the data supports it, which it should) and selling opportunities on any “dovish” commentary from the ECB. 88.50-91.00 will be the immediate-term range we’ll be looking to manage in the USD, and 1.25-1.23 in the Euro.

10 yr technical picture of the EUR/USD