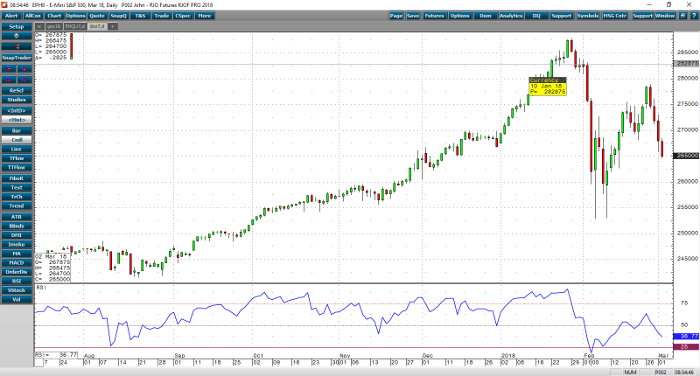

Stocks opened lower again today and are poised to close that way for the fourth straight session. The E-mini S&P and mini Dow are both now in negative territory for 2018, while the Nasdaq still has some downside to go to achieve that. The E-mini S&P put in an all-time high of 2878.50 on January 29 before quickly falling just over 12% to 2529 in the matter of a week. After a strong recovery (albeit one that fell well short of testing the all-time high), we are back on the schneid. We are currently sitting about 8% off of the 2878.50 high.

Earnings season is almost over, and the jobs data will not come out until next Friday, March 9. In the absence of earnings news, we’re going to need some good data from the news cycle to right the ship. All eyes are now focused on the Fed as they’re likely to announce the first of a projected four rate hikes for the year on Wednesday, March 21.

E-mini S&P 500 Mar ’18 Daily Chart