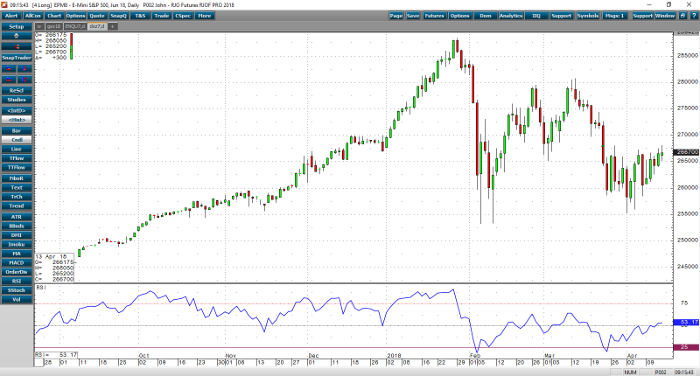

Stocks hit their highest levels since the giant selloff on 3/22 overnight but are paring some of those gains after the open. The gains we have seen this week are pretty impressive considering the war of words with Russia seems to be escalating along with the ongoing crisis in Syria. Technically speaking, the double bottom followed by a pattern of higher highs and higher lows seems to bode well for the indices moving forward. We’re running into some trend line resistance on the E-mini S&P, and quite frankly, I wouldn’t be surprised to see some profit taking heading into the weekend given the circumstances mentioned above.

Adding to the weakness, the Consumer Sentiment reading came out soft. We were expecting to see 101.0, but the data fell short and reported only 97.8. It’s not the biggest of misses, but markets were expecting something a bit more in line with the March reading of 101.4, which was a 14 year high. We also saw a JOLTS reading of 6.052. That reading was in line but slightly lower than expectations. Economic news next week is pretty light, but we’re back into earnings season. Those readings and Syria news are likely to drive direction next week.

E-mini Jun ’18 Daily Chart