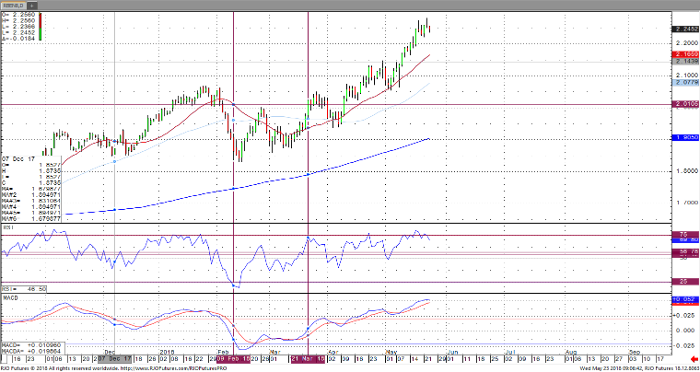

RBOB is coming off yesterday’s contract high, down 0.0148 or .6538% on the day, to 2.2488 further extending the reversal. RBOB has found support on reports that Russian April gasoline exports fell by 37% off the previous month, however, lower crude oil prices and a rise in API gasoline stockpiles of 980,000 barrels have weighed down on prices. API distillate stocks had a weekly decline of 1.4 million barrels as expected with RBOB looking ahead to the EIA report this morning. RBOB should find longer term support ahead of the US driving season as inventories should continue to accumulate with consumption increasing which accelerates demand and moves prices higher. RBOB has upward momentum but appears overbought with resistance seen at the double top of 2.2585 and uptrend channel support at 2.2444 and 2.2200.

RBOB Gasoline Jul ’18 Daily Chart