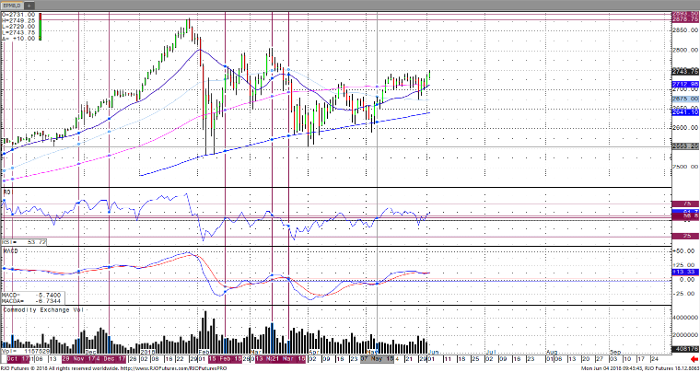

Stocks are trading higher for the second consecutive session following strong economic reports on Friday. The U.S. added 223,000 new jobs in May, well above the expected 188,000 while unemployment fell to 3.8 percent, the lowest since 2000. Wage growth was firm with the annualized rate coming in at 2.7 percent. Political turmoil in Italy and Spain has eased, global outlook is strong and positive U.S. economic news is supportive in the near-term ahead of the FOMC meeting on June 13, with the Fed largely expected to raise rates a quarter of a percentage. Continue to monitor trade discussions between the U.S. and China, as well as with our North American trading partners and the EU. Momentum is positive in the near-term with support in the E-mini S&P 500 is seen at 2712.29 with resistance at 2758 and 2767 respectively.

E-mini S&P 500 Jun ’18 Daily Chart