December gold futures are likely to remain under pressure until the current risk on environment changes, and we see more volatility come back to the market. President Trump recently walked back the rhetoric he has taken with many countries over unfair trade practices. Having said that, he has raised the prospect of a deal with the EU on a long-term trade deal that could involve them buying more US soybean and LNG. This, for the time being, is nothing more than a headline but could obviously build to something more. The prospect of “winning” a trade war isn’t likely, but if China were to blink first in this situation we could equity markets surge and continue to put pressure on safe havens such as gold. A third-rate hike is discounted at 100% odds at the September 25-26th meeting, with a fourth likely in December as well.

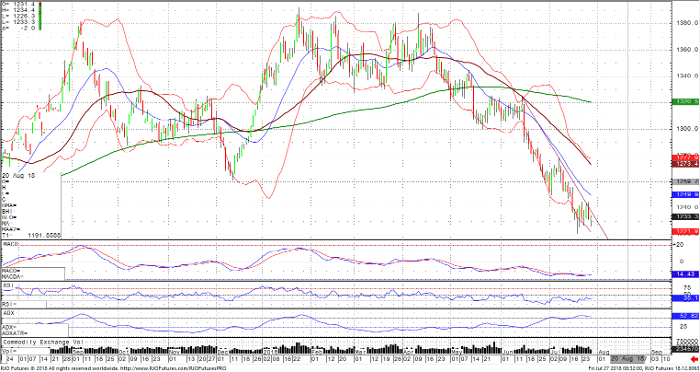

US GDP data will likely put even further pressure on the precious metal following a quite pleasant 4.1% growth number. Though well off high estimates with a 5 handle in front, it’s the best GDP number we have seen in 3.5 years. Investors are likely to continue to pile into riskier assets and press the bets on this news. A technical look at December gold will show that it’s a clear stair step down in a sharp downtrend, with another washout below 1200 likely in my opinion. Gold is likely to find support around 1160-1175 and I believe the market will press anyone else who might be long out of the market before covering the already massive short futures position that the speculative funds currently hold.

Gold Dec ’18 Daily Chart