This morning’s jobs data came out inline, but on the lower end of expectations. The nonfarm payroll number was expected to come in around 190,000 but fell a bit short at 157,000. On the other hand, last month’s number was revised higher by 35,000. We also saw the unemployment rate fall a tenth of a percent to 3.9%. The highlight of the report was the manufacturing data, which despite only expecting about 15,000, came in at 37,000.

The market reaction in the wake of the data has been pretty subdued. Perhaps the PMI and ISM numbers will be able to provide the market with a reason to make a move of consequence. However, heading into the open, the four major indices are basically unchanged. Next week’s slate of data is pretty light, but we’ll continue to monitor any developments regarding the tariff talk out of Washington.

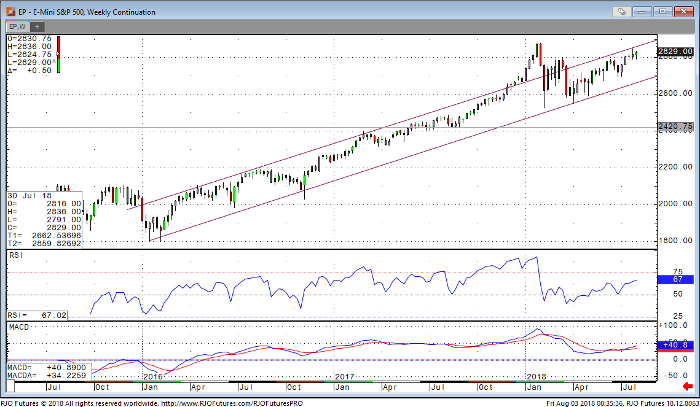

E-mini S&P 500 Weekly Chart