U.S. stocks rebounded Friday morning after data revealed that the economy grew at a faster rate than anticipated during the first quarter. The markets were trading considerably lower before the GDP release after poor earnings from Exxon Mobil and Intel. According to CNBC, “First-quarter GDP expanded by 3.2% in the first quarter, the Bureau of Economic Analysis said in its initial read of the economy for that period. Economists polled by Dow Jones expected the U.S. economy increased by 2.5% in the first quarter. It was the first time since 2015 that first-quarter GDP topped 3%.” Exxon fell almost 3% after reporting their earnings in the premarket badly missing the expectations from the analysts. Intel fell more than 7% after providing a weaker than expected revenue forecast for the year. Aside from the U.S. GDP report, investors will be looking for a glimpse of consumer sentiment, when the University of Michigan releases its index at 10 AM (ET).

Today’s support is 291500 and 290500, with resistance checking in at 293700 and 294700.

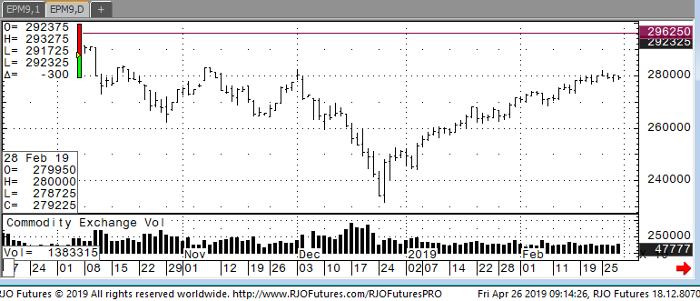

E-Mini S&P 500 Jun ’19 Daily Chart