As agricultural markets prepare for the USDA World Agricultural Supply and Demand Estimates (WASDE) tomorrow, the markets are heavily anticipating the report for many reasons. The main reasons being the dry, drought conditions affecting the harvest in Argentina and South America as well as the combination of dryness and flooding in areas of the wheat belt in the United States.

While the soybeans and wheat markets have priced in these bullish factors, the markets will be heavily anticipating if it has been too much or not enough. Meaning, depending on the outcome of the report, markets will be interested to see if the pricing in of these weather factors has been overdone or underestimated. Many experts have revised their Argentinian estimates to the downside, and just yesterday I spoke with a farmer who typically has his land underwater on the Ohio River, but it is twice as deep with this year’s flooding.

We also wonder given the bullish price action in soybeans, even though many farmers stick with their allocation among land and certain crops, will the attractiveness of beans take acreage from corn?

To discuss some of the ways to position amid this report and others, please contact me at your convenience.

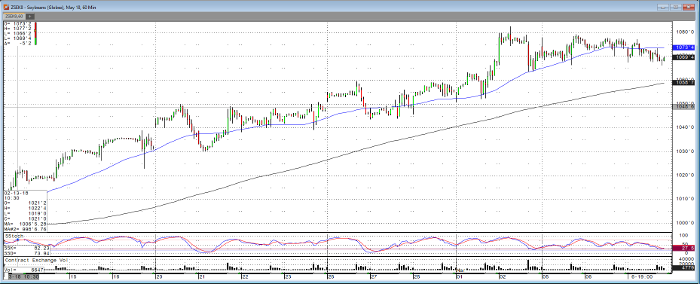

Soybeans May ’18 60min Chart

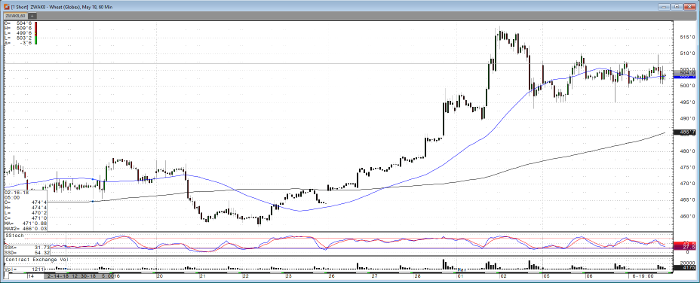

Wheat May ’18 60min chart