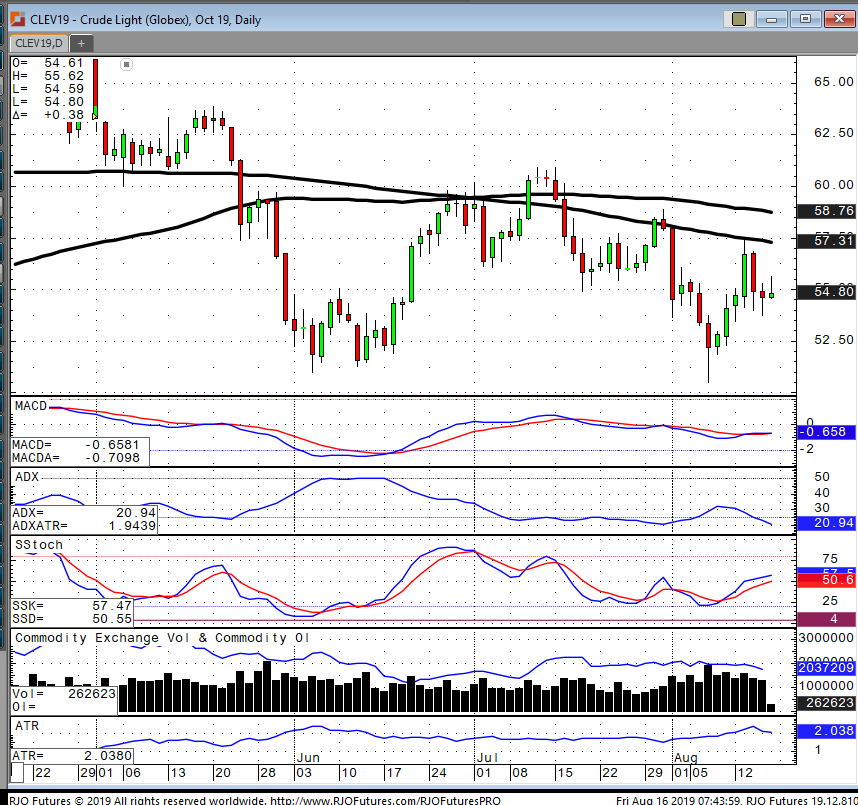

Crude oil prices continue to consolidate, and trend lower weighed in by the escalation in U.S.- China trade tensions and fears that the global economy will continue to slowdown. Looking at rising oil production in the U.S. and with new pipelines coming on in the next few months this should also pressure prices. Watch the weekly inventory data as the 5-year average is 426 M/b in inventory against current levels of 433 M/b leaving a supply glut. I would expect prices to push back down to the contract lows of $50.50 if crude can break critical support at $53.75.