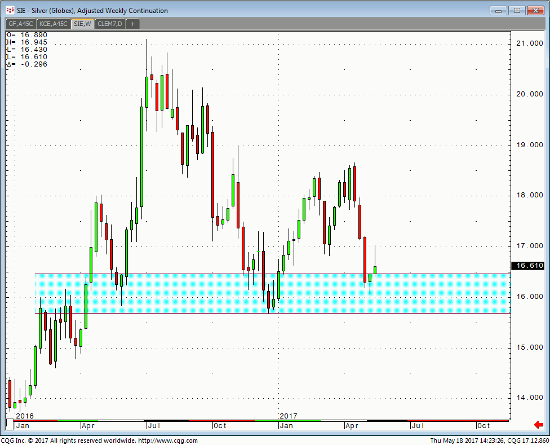

July silver is trading $16.65, about 25 cents on the day. Again, per my previous articles, I have discussed the potential for this silver to find a technical bottom around $16.00. The relief rally from the recent lows has been met with formidable resistance. If the $16.00 level continues to hold, a close above $17.50 will solidify the near term lows. Therefore, I think it is too early to assume the bottoms are in near-term silver. Today’s pullback doesn’t help the bull camp.

From the fundamental perspective, silver market participants are still trying to gauge the possible outcome of Trump’s interference, with the ongoing investigation of his Russia ties and a possibility of any cover-ups surrounding that matter. This issue is far from being over, and at the moment, it is continuing to dominate the news. The bull camp in silver would have a hard time sustaining a rally out of Washington news unless a more solid story develops very soon.

The commitment of traders with options report for the week ending May 9 showed that the non-reportable and non-commercial position holding combined 71,091 contracts. Most likely, the May 16 reading, which would be released tomorrow May 19, 2017, will probably show a bump in holdings for the above group. Like I stated above, with the absence of real geopolitical risk, I’m not sure the bulls can substance this pop in silver price unless more bad news develops out of Washington.

From a technical perspective, nothing changed from what I mentioned last week:

“I’m getting less and less bearish as prices continue to decline into weekly support lines.” Frankly, $16.00 better hold or else more price pressure to the downside will happen as the result of discourage bulls abandoning the market. But then again, any sustained close above lows $17.00 will probably start a momentum run to the upside. It will set up a higher low against the December 2016 low signaling near-term lows.

Silver Weekly Chart