The weather is shifting to a less threatening outlook and with crop conditions at such low levels a few weeks ago, the more normal weather should result in improvements. The market closed below the 50-day MA for the first time since May 14th. Better than expected rains moved across Iowa, N. Illinois, Wisconsin, and N. Indiana which put some pressure on the markets yesterday. Export sales also disappointed with just 200,000 tonnes for the current marketing year. The lack of clarity on planted acreage continues to cause angst among traders and a shift to cooler next week is seen as a slightly bearish force. The latest 6-10 day forecast has cooler temps and below normal precipitation for all of the Midwest July 24-28th.

December corn is down almost 30 cents on the week so far and should put a bearish outside week lower on the close today. The long- term forecasts have certainly thrown a wrench in the bull camps thinking, but with acreage adjustments likely to come plus the large percentage that was planted late, we still think buying healthy pullbacks is a valid choice. Resistance comes in at 437 and support at 418.

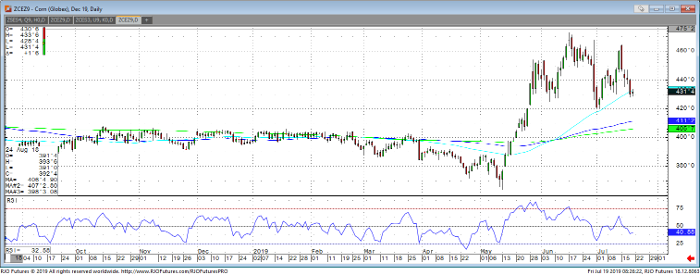

Corn Dec ’19 Daily Chart