With the US Indices looking technically over-extended on the monthly and weekly timeframes, combined with either bearish or indecision candles that have formed on the weekly charts as well, the markets may be preparing to head lower in the shorter-to-medium term. This could be as a result of the US President Donald Trump’s impeachment trial and it’s uncertain outcome, or general uncertainty as to the longevity of this current bull run. In light of this, we may be cautious ahead of this week, and highlighting the recent return to the monthly uptrend that the Bond futures are showing technically.

The monthly charts of both the 30-Year T-bonds and the 10-Year T-Notes have produced bullish monthly candles, and strong daily uptrends.

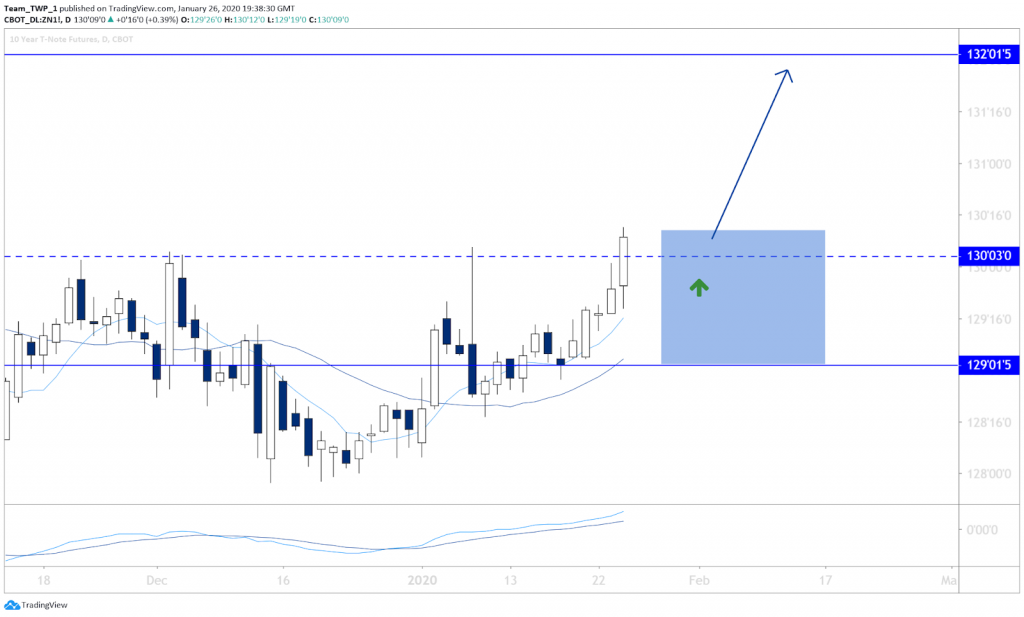

A retracement back down to local support levels is likely due in the near future, possibly towards the end of the week, offering a strong likelihood of a continued move to the upside.

The daily charts in both cases are now above recent resistance and due for a retracement.

30-Year T-Bond

Price can reasonably be expected to return to between 160,20 and 158,20 to test for support, with a fresh high potential of 163,00. There may be soft resistance at 160,00.

A medium or small-sized bullish candle that forms between the 8 & 21 simple moving averages could provide an economic and lower-risk entry into the future extension.

156,20 may be a technically suitable option for a stop-loss.

10-Year T-Note

Similarly, price on this chart can reasonably be expected to return to an area between 130- 129, especially where it may overlap with the 8 & 21 moving averages.

There may be soft resistance at 130,00, and we would be waiting for a small, or small-medium bullish candlestick to form in this area, with a technical stop-loss placement at or below 128,28.