For the third week in a row, the EIA Petroleum status report estimated astounding drawdowns for crude inventories with a draw of 4.7 million barrels, adding to the three week consumption of over 18 million barrels of crude oil. Last week the report estimated a draw of 7.6 million barrels, and while this week’s report was a meager 2.9 million barrels smaller drawdown, it’s still a strong indicator of recent demand.

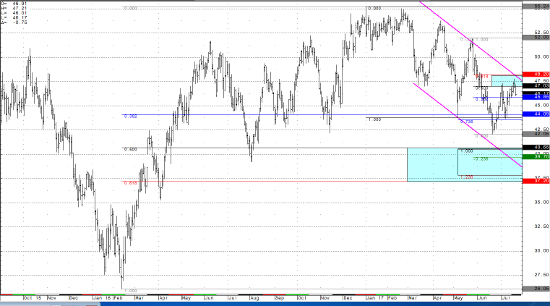

I discussed last week how breaking below the May 43.76 lows from the continuous contract was a very important level test. The same set of technical indicators that were diving the market price action since last week, including two Fibonacci measurements, the lows from July of last year, and the channel the market has been holding the last 4 months. The 44.00 support from equal legs and 50% fibs on the smaller timeframe charts, which I mentioned in last week’s article, is proving supportive and may be signaling the bulls are gaining back the ability to defend their ground. Support for the week comes in from bulls defending the weekly lows at 45.81, and while above another rally to 47.74 highs is still on the table.

Resistance for this week is expected into channel and Fibonacci confluence zone from 47.75 to 48.80. There is an equal legs measurement at 48.80, which aligns with channel trend line resistance. A breakout higher may head naturally to test these levels, while a break below the weeks low turns the outlook more bearish. If the market continues to break down below 45.81 lows of the week, then below the lows of July at 41.05 for the August contract, WTI crude futures should find a support level where there is a confluence of Fibonacci support bands (retracements and extensions) between 40.65 and 37.20 (daily continuous chart below). In the near-term, the prior lows into 44.00 will be the next level of support to watch, followed by the prior lows of 42.05 for the September contract.

Aug ’17 Crude Light Daily Chart