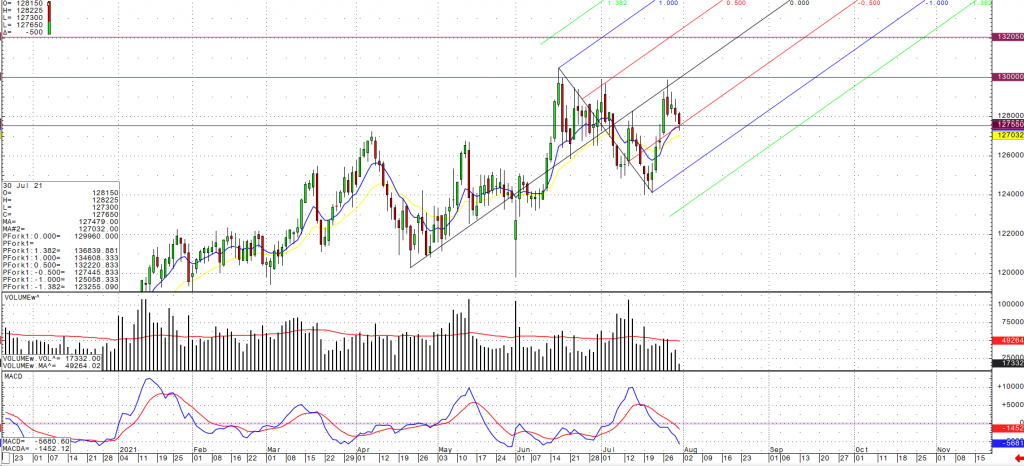

With the recent moves in the October cattle market, it looks to be in a bit of overbought territory. Recent news from China is that they are still expanding their beef imports from the US which should lend some support to the market but that remains to be seen. Other supporting factors right now though are the declining supply combined with some strength in consumer demand, currently Oct cattle is trading at 127.5 which is on a near term support level. Cash business seems to be improving with heavier volume traded this week and higher trending prices. 130 looks to be the upside resistance level, if a breakout happens, we need to see a close above that level next week in my opinion.

Some of the fundamental news in accordance with export numbers and cash prices are as follows: The largest buyer this week in the weekly export sales report was South Korea at 8,222 tonnes, followed by Japan at 6,085 and China at 4,488. South Korea has the most commitments for 2021 at 212,700 tonnes, followed by Japan at 185,600 and China at 119,000. Last year, China had booked 15,000 tonnes by this time of the year and just 4,100 tonnes for this time of year 2 years ago. Cash live cattle traded in heavier volume on Thursday at higher prices than last week. In Kansas 8,410 head traded at 118-123.50 with an average price of 120.13, up from an average of 119 last week. In Nebraska 1,965 head traded at 122-123 with an average of 122.13, up from 121.67 last week. In Texas/Oklahoma 3,784 head traded at 120, up from 118.77 last week. The USDA boxed beef cutout closed $2.06 higher at $275.22. This was up from $266.14 the previous week and was the highest the cutout had been since July 9.