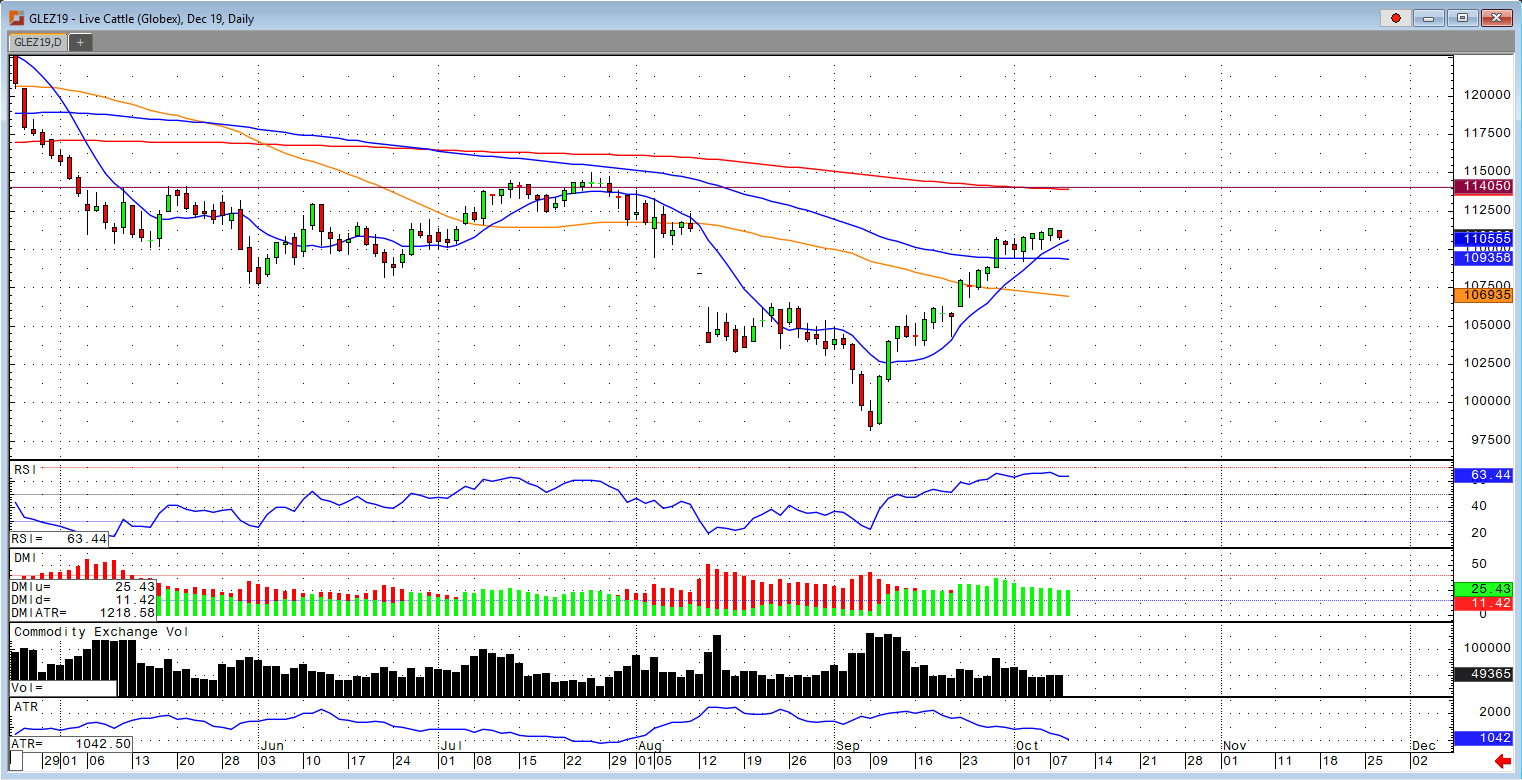

In the December cattle contract, we have seen some consolidation over the past seven trading sessions which is most likely the market attempting to correct its overbought condition. The cash market has not traded yet this week, but the market is holding firm with the $107 cash trade from the week before. If there is any bearish news that comes out, then we could see selling in the market because of the overbought condition as previously mentioned. When you look at the CoT from Oct.1st showed that the managed money when from a NET short position to a NET long position. One of the major fundamental factors that will be coming to the market is the forecast for snow in the northern plains for the weekend and this harsh weather could be seen as a supportive factor in the markets. USDA boxed beef cutout values were up $1.99 at mid-session yesterday and closed $2.51 higher at $213.60. This was up from $213.47 the prior week. There is no trade in the cash market so far this week. Cash cattle traded in Kansas on Friday at $107, up from $103 to $104.50 the previous week and $101.60 two weeks ago. In Texas, they traded at $107 (3,198 head) on Friday from $106 Thursday (2,872 head) which was up from $103-$104 the previous week and $101 two weeks ago. The USDA estimated cattle slaughter came in at 117,000 head yesterday. This brings the total for the week so far to 233,000 head, down from 234,000 last week at this time and down from 234,000 a year ago.

The trend in the market is still up but we need to see if there any cash trades take place this week to give more support to the market. A break overt the $111.50 level would lead me to believe that we see a continuation to the July highs of $115.00 or at least around the 200-day moving average of $114.00.