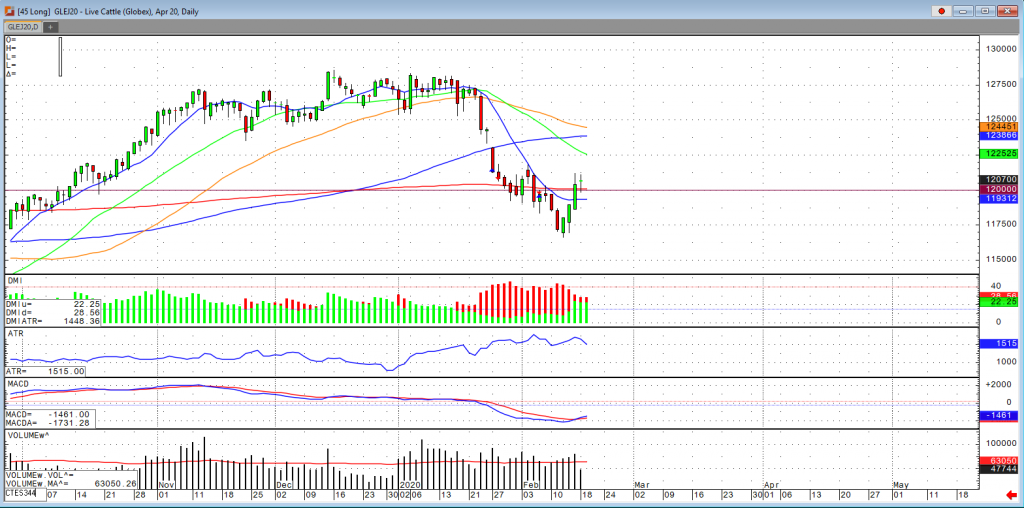

There is plenty of beef in the short-term, but we may see a technical recovery. We would need to see some higher prices in cash cattle to support this uptrend. Right now, we’re looking at the highest beef production for this year since 2008, demand on the other had looks to sluggish causing a limited upside forecast. China did come out and say they are going to cut tariffs on some agriculture products which includes beef, but since they are not an aggressive buyer of beef, traders are reluctant to buy the market on this kind of news alone. The USDA boxed beef cutout was down 86-cents at mid-session yesterday and closed $1.13 lower at $206.13. This was down from $207.83 the previous week and was the lowest the cutout had been since October 17, 2018.

Cash live cattle were quiet on Monday and Tuesday, except for 18 loads that traded in Iowa/Minnesota at 119. The 5-area weighted average steer price last week was 118.90, down from 121.05 the previous week and 124.96 a year ago. The USDA estimated cattle slaughter came in at 123,000 head yesterday. This brings the total for the week so far to 230,000 head, down from 241,000 last week, but up from 215,000 a year ago. For the USDA Cattle-on-feed report for Friday, traders see placements of cattle into feedlots coming in at 1.5% above a year ago (range of down 2.2% to up 3.5%). Marketing’s for the month of January are expected to be up 0.7% in a range of down 2.4% to up 1.6%. This would leave feedlot supply at as of February 1 at 2.4% above last year. The range is up 1.8% to up 3%.