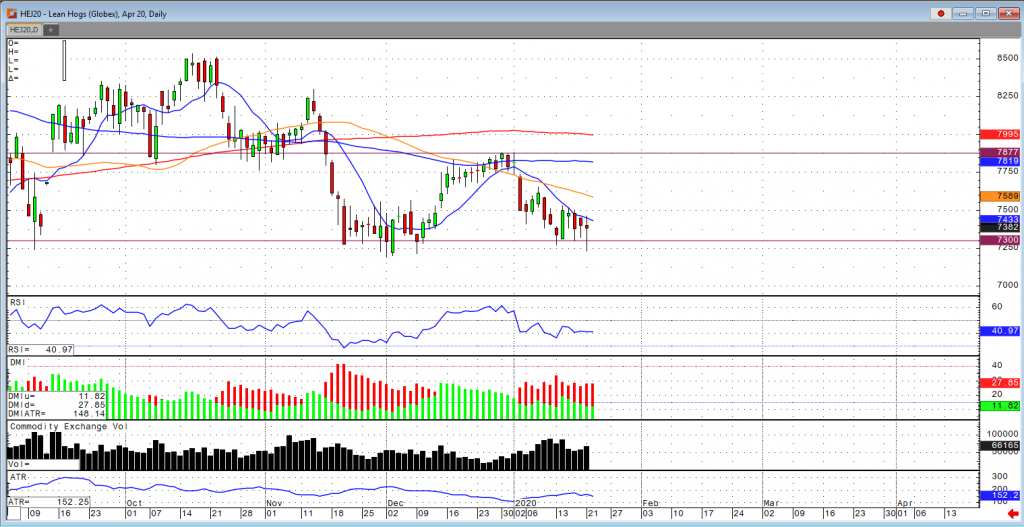

The April hogs market seemed to reject the downside breakout by hitting a level not seen since December 9th but rallied to close 150 points off the lows. China has a huge demand for U.S. pork and will start to actively import our pork which should cause U.S. supplies to start tightening after reaching record high levels. The pork cut-out values are the highest since middle December which gives an indication that there is still high demand. China’s national average spot pig price is up 7.3% for the month and over 200% year over year. CME’s hog index is at $60.45 which is up from last week’s price of $58.99. The path of least resistance is upward in the pork market and I suspect that the April Hog market will test the 10-day moving average and break through that level to re-test the December highs of 78.75 over the next 30-day time period. The USDA estimated hog slaughter came in at 498,000 head yesterday. This brings the total for the week so far to 909,000 head, down from 995,000 last week, but up from 867,000 a year ago. The USDA pork cutout, released after the close yesterday, came in at $77.37, up $1.21 from $76.16 on Monday and up from $73.43 the previous week and $69.45 a year ago. This is the highest the cutout has been since December 17.

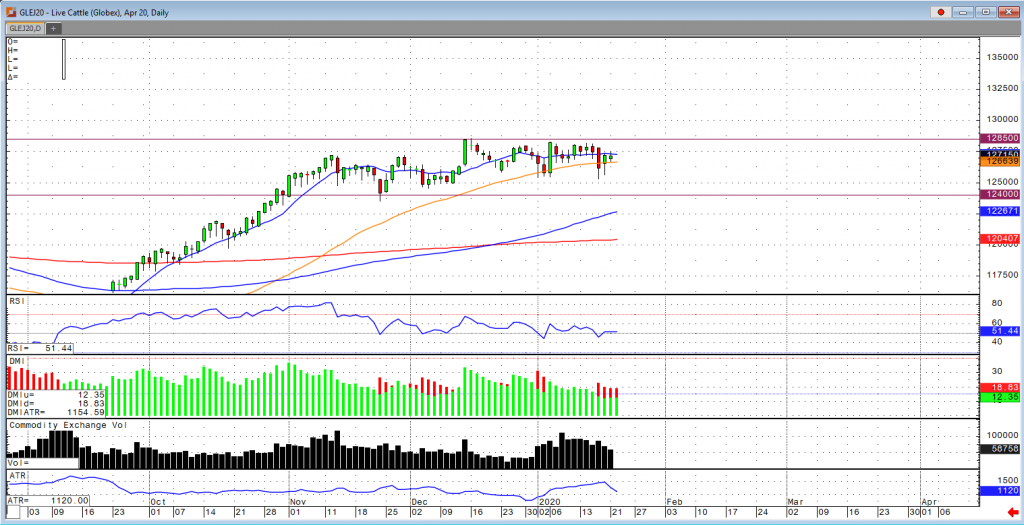

April live cattle continues to trade in a consolidated market for the past 2 ½ months, trading in a price range from $125 to $128 with the market hitting a low of $124 back on November 22nd. These prices still remain at a $3-$4 premium to the cash market and with a steady rise of open interest in the market, that gives an indication that this market could break out of this range to the upside. If we were to see higher cash market prices, we would need to see stronger beef price action before anything else. There were no cash trades reported for Tuesday, but on Monday we had 126 head reported at $124, the lower end of last week’s range.

Fundamentally, there is little positive weather premium in the futures market as another winter system moves through the Midwest. The USDA estimated cattle slaughter came in at 123,000 head yesterday. This brings the total for the week so far to 245,000 head, up from 244,000 last week and up from 233,000 a year ago. The USDA boxed beef cutout was up 79 cents at mid-session yesterday but closed 13 cents lower at $214.51. This was up from $212.76 the previous week but down from $215.26 a year ago. The COT report showed managed money traders were net buyers of 2,917 cattle contracts for the week ending January 14, increasing their net long position to 83,603. The estimated slaughter came in at 631,000 head last week, down from 640,000 the previous week but up from an actual slaughter of 626,000 a year ago. The estimated average dressed steer weight was 829 pounds last week, up from 827 the previous week and 818 a year ago. Estimated beef production came in at 521.8 million pounds last week, down from 528.1 million the previous week and up from 511.1 million a year ago.