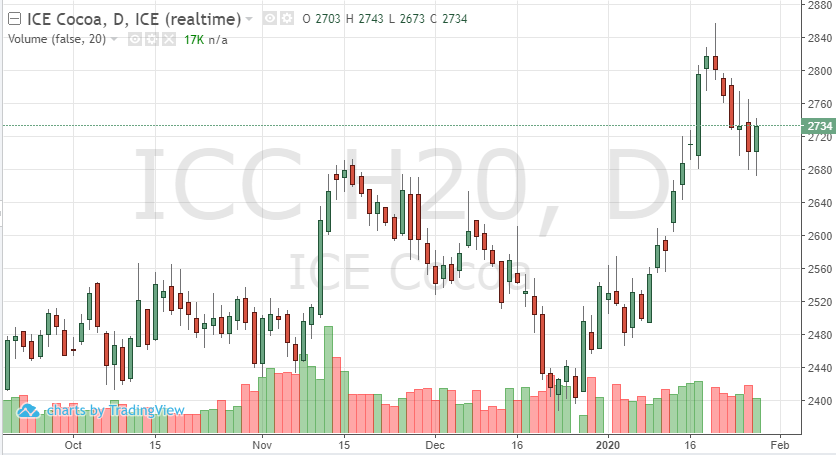

After cocoa rallied to a contract high, the fundamentals have weakened prices. Trader’s saw a boost in prices due to an increase in demand after last quarter’s grinding numbers. Of late, the global markets have weighed on commodities. Concerns about the coronavirus have affected the equity and futures markets. Asian demand of the soft has come into play. If this virus affects exports in large grinding nations, Asia specifically, we can see prices continue to move lower.

Production will need to come in lower than expected to give cocoa prices support. Technically, 2680 is support but the market would need a few more down sessions to sit there. Demand and coronavirus will guide cocoa over the next week as more cases and the spread continues.