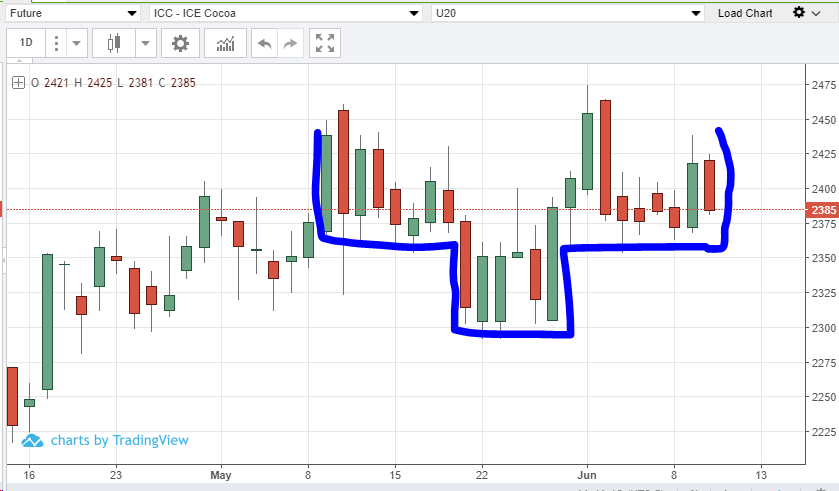

September ’20 cocoa futures price fell by 1.41 during yesterday’s session (6/10/20) which must be disappointing to the bulls with so much potential for a rally. The story of ongoing issues related to excessive hot and dry weather in major growing regions reinforces the chances of lower production this season. This is an important factor in supporting current price levels while grinding higher. What has prevented this market from taking off to the upside has been global demand concerns. However, it seems as if the Eurozone has maintained strong demand even through the pandemic, and Asian prospects seems strong as well. With increasing economic stability in the major purchasing regions, there is a lot of upside price potential for a commodity struggling with poor growing conditions. From a technical perspective even with today’s move down in prices, the chart looks bullish. We have what could be a clear reverse head-and-shoulders pattern on the charts which may indicate rising prices ahead.