Cocoa’s storyline this year has been very repetitive – supply/demand, currencies, global risk, all remain the main drivers of this market. Currently, demand is rising. N. American demand appears to be strengthening – long-term this should be supportive to prices since that region’s data has been typically weaker. With production levels(supply) being somewhat of a non-factor the demand side of the equation has taken center stage.

The currencies are also moving the cocoa market in the short-term. A strong dollar, weaker euro and pound have held the September contract at these levels. Traders are wondering if we are headed for consolidation over the next week.

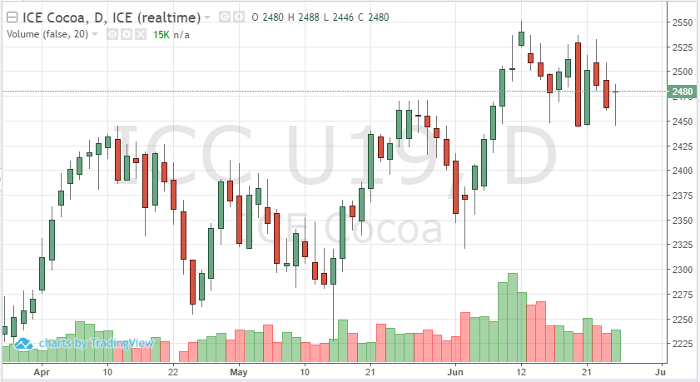

With Wednesday’s trade ending the day near unchanged – speculators are wondering if we are finding a new range. 2550 has been resistance, 2450 has been support and in-between depends on the day. Look for supply/demand to guide us the rest of the week followed by the technicals. If buyers aren’t convinced the longer-term outlook is as bullish, we may see a pullback to 2400. But with the current weather, currency volatility and risk on (and off) sentiment, a consolidated range is more realistic leading to a breakout.

Cocoa Sep ’19 Daily Chart