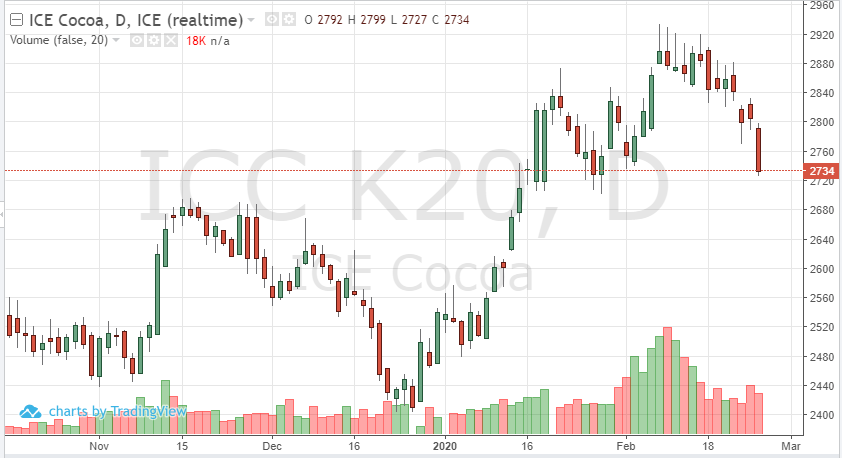

May cocoa futures continue to move lower as fear grows that the coronavirus outbreak could continue to get worse. Until a vaccine is in place, which could be six weeks away, the threat of a growing number of cases will continue. The virus could impact the demand of the soft in Europe and Asia. Grinding data will provide guidance as it is released.

In the short-term, the euro and pound have stayed strong, providing some support to prices. On Wednesday, the May contract found support at 2725. As news breaks, the technicals could be pushed to the side and have little impact on trading.

The weather in West Africa will also be monitored, light rain is expected in the near-term, but this may not affect prices if the accumulation remains minimal.

Traders will need to look at positions on a day-to-day basis since the future is unknown of how large the number of the coronavirus cases could get.