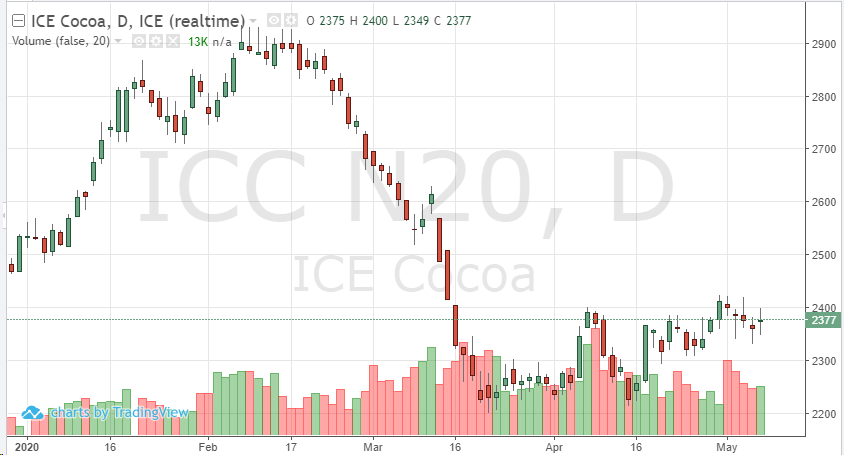

As cocoa futures continue to be range bound and ending some recent trading days nearly unchanged, traders will focus on the demand of soft. It is hard to anticipate where prices will be in the coming days, weeks, months or even years as there is too much unknown globally. The demand of cocoa has been weak for a while and there is little current news that could help a push higher in the short-term. The hope is Q3 and 4 will show some recovery in commodities and the equity markets.

For now, expect consolidation, followed by volatility and a repeat of that cycle. The equity market and currencies will be factors in the day to day trade of cocoa. Supply and demand will continue to take a back seat as most areas of the world have taken a step back from purchasing many commodities.

Technically, the July contract continues to hit resistance around 2415, support appears around 2310.