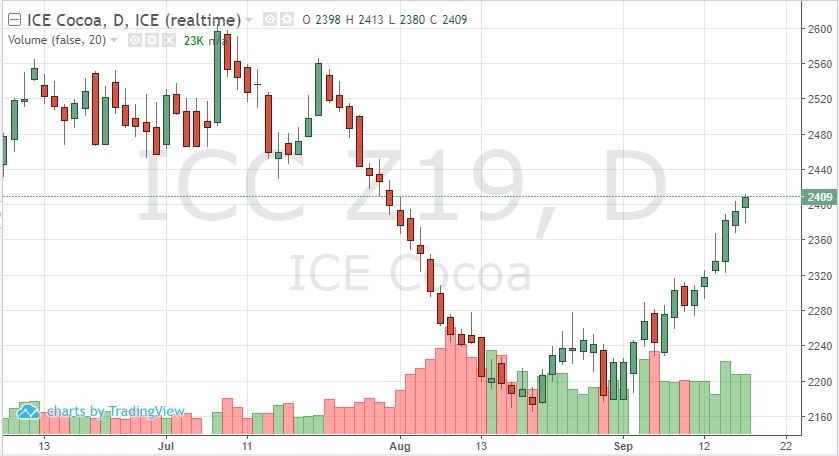

It appears the lows may have been put in the December cocoa futures contracts. Although the contract has hit overbought levels, the technicals and fundamentals are working together to get prices back to 2500. As the panic in the global markets has taken a short breather, cocoa futures have put together six positive sessions. Technically, prices continue to close above the 9-day moving average. A long-term bullish technical signal was also reached with a close above the 200-day moving average. Unfortunately, any disruption in the global equities creates pullbacks in the softs’ prices – but those pullbacks have created buying opportunities.

Traders appear to be adding to positions as futures’ prices climb, taking a more conservative approach after the decline in prices during July/August. The euro and pound will add to the support and this move higher as these currencies have moved with market conditions and risk sentiment. Supply and demand have taken a backseat currently and many traders are looking outside the fundamentals. Resistance is around 2445 then at 2495. Positive economic news alongside more longs entering the market will be needed to test contract highs as we enter the final quarter of the year. COT data after the close Friday will gives us a feel for how traders are positioning.