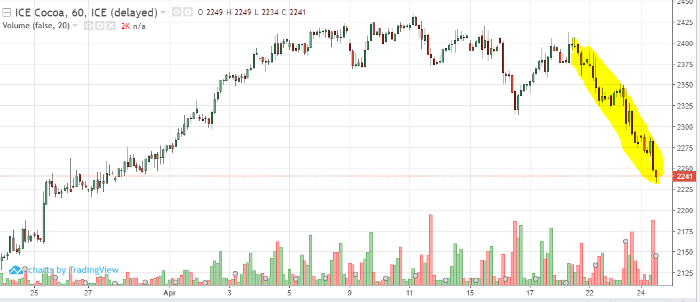

July ’19 cocoa futures crash down after consolidating in over bought territory for most of this month. The major sell-off started slowly at first the night of April 18th with prices trading around $2400 per ton. Since then, cocoa futures have given back a major portion of the gains made during the late march/ early April bull run where we saw prices close higher for 14 days straight. It appears the market has grown impatient waiting to see if supply concerns for the mid-crop are valid and is correcting fiercely. Prices are in danger of a continued decline with market momentum still pushing down. At the time of writing, June ’19 cocoa is trading at $2241/ton and there is a possibility it could continue down to $2175 with bears in near-term control. Caution should be paid by bears and patience is advised to bulls; below average rain fall with continued dry soil conditions on the Ivory coast and crops under threat of “Swollen Shoot Virus” in Ghana could still impact mid-crop harvest and see prices bounce back up.

Cocoa Jul ’19 Daily Chart