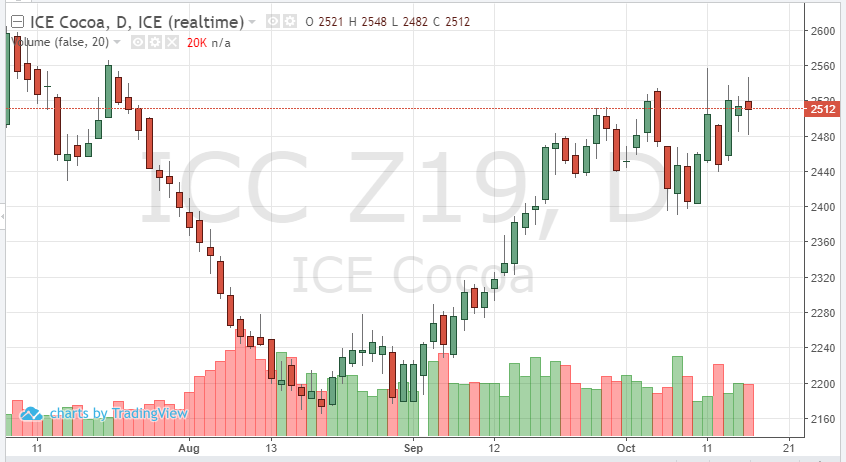

Cocoa has been a macro trade of late. The December contract is range bound in this recent consolidation. Due to a more positive global tone, possible Brexit deal as well, cocoa’s demand could be on the rise. If the demand outlook rises, look for support at these current prices at the higher end of this channel. As a Brexit deal could push the euro and pound higher, other outside global factors are still uncertain. Trade talks, Asian demand and North American data are all factors as well. Grinding data this week will also be processed and added to the trading equation as we enter the weekend. Will this data help the December contract break out and continue its climb we saw in October? What will the COT data show after Friday’s close? These questions will provide short-term volatility. A continued close above 2500 is supportive for prices. A close above 2560 and the 9-day moving average is critical– these key technical points should reaffirm last quarter’s trend as we head towards year end and the next contract roll.

Cocoa Dec 19 Daily Chart