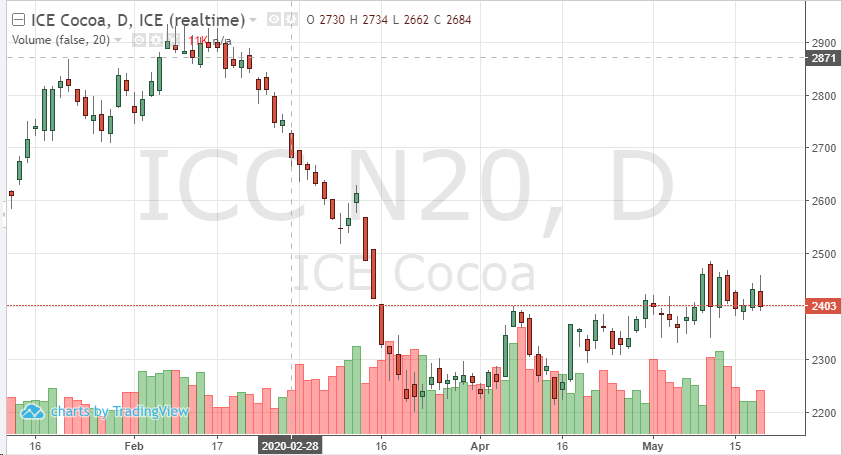

Looking at the July cocoa chart, traders could see the contract has found support. The move higher has been a grind, but prices above 2400 may be here to stay in the short-term. Technically, the chart is showing resistance has been broken and a new consolidation range has been found. A close above 2440 is needed to have the momentum continue.

Fundamentally, production levels have been lowered due to crop issues. Rainfall has been scarce after output was already affected by dryer than normal conditions earlier this year. Traders have been waiting for a pullback in supply to help boost prices. The bulls have also anticipated the demand in cocoa to gain ground and it appears to be moving that direction. As parts of the world re-opens and the global equity markets try to recover losses from the past few months, the “food” commodities are following the trend. Cocoa demand should grow as more locations find the new “norm.”

Traders should have patience and look at key technical levels and supply and demand indicators to decide which path to take on trades.